Republican presidential candidate Donald Trump often likes to cast himself as a protector of workers and jobs as well as a great businessman. However, recently he’s come under considerable scrutiny as it’s been recently revealed that he’s been involved in more than 3,500 lawsuits over the past 3 decades. A large number of these pertain to ordinary Americans who say that Trump and his companies have refused to pay them for their work. According to USA Today, these include a Florida dishwasher, a New Jersey glass company, a plumber, a carpet company, painters, 48 waiters, dozens of bartenders and other hourly workers at his resorts and clubs all over the country, real estate brokers who sold his properties, and even several law firms that once represented him in these suits and others. Trump and co. have also been cited for 24 violations under the Fair Labor Standards Act since 2005 for failing to pay overtime or minimum wage, according to the US Department of Labor data. In addition to the lawsuits, there were more than 200 mechanic’s liens filed by contractors and employees against Trump, claiming that they were owed money for their work since the 1980s. These range from a $75,000 from a Plainview, NY, heating and air conditioning company to a $1 million claim from a New York City real estate banking firm. On his Taj Mahal casino in Atlantic City, the New Jersey Casino Commission in 1990 show that at least 253 subcontractors weren’t paid in full or on time, included workers who installed chandeliers, walls, and plumbing.

All of these actions described above paint Trump and his sprawling organization frequently failing to pay small businesses and individuals, then sometimes tying them up in court and other negotiations for years. In some cases, Trump’s team financially overpowers and outlasts much smaller opponents, sometimes draining their resources. Some just give up the fight, settle for less, end up in bankruptcy, or out of business altogether. Such actions described above are well-known cases of wage theft. Donald Trump has been a long practitioner of this but he’s hardly the only one. In recent years, workers ranging from NFL cheerleaders, Senate cafeteria workers, fast food workers, retail workers, high tech engineers, nail salon workers, and computer animators have found themselves victimized by this very real and very heinous act by their employers. Often, employees find themselves powerless to do anything about it. And if they do, they often have to act through the court system and risk losing almost everything. But since people rely on their job so much to make a living, this is a very important issue with it becoming the fastest growing crime wave in the United States. But it’s not often reported and it’s tough to see how widespread this problem is. However, at any rate, wage theft is a problem we need to discuss and need to demand action on because it affects so many people’s lives. And here I have this handy FAQ guide to show you.

Yes, this is what wage theft actually is. Unfortunately, Mr. Orange Nuclear Meltdown doesn’t understand this. Because he’s been a constant violator according to the lawsuits former employees subject him to.

What Is Wage Theft?

Wage theft is when an employer denies pay and/or benefits that are rightfully owed to an employee. Wage theft can be conducted through various means such as failure to pay overtime, minimum wage violations, employee misclassification, illegal deductions in pay, working off the clock, having tips stolen, or not being paid at all. In short, the boss is not paying workers for all of their work. Or not paying for the work at the rate they said they would or what the employees are entitled to by law.

If you experience any of these at work, you might be a victim of wage theft. Because these are common signs like being paid under the table, kept working despite clocking out early, having tips stolen, and not receiving meal or rest breaks.

Types of Wage Theft:

Overtime– This is the most common form of wage theft. The US Fair Labor Standards Act dictates that employees are entitled to receive overtime pay calculated at least 1.5 the regular rate for all time worked past 40 hours a week. Some exemptions only apply to public service agencies or employees who meet certain requirements in accordance to their job duties along with no less than a $455 weekly salary (or $23,660 a year). So unless employees meet the exemption criteria, they’re usually entitled to overtime if they work over 40 hours a week period. Employers can’t change overtime laws and can’t avoid paying overtime by enacting a no-overtime policy or getting employees to agree on special deals. Unfortunately, it’s common for employers to treat overtime as a personal choice when it’s not. And despite regulations, many employees aren’t being paid overtime due to them. Common overtime violations include:

- Improperly Calculated Overtime Pay– Employers must calculate overtime on the actual 40-hour workweek regardless of pay period whether it be weekly, bi-weekly, or monthly. Many employers are said to average hours over 2 or more weeks, not including all payments in calculating overtime pay rate, not paying employees for all hours worked over a 40 hour work week, not including time spent preparing for work (donning and doffing), and requiring employees to wort through unpaid meal breaks. Such errors may not always be accidental.

- Comp Time Instead of Overtime Pay– Compensatory time is paid time off for extra hours worked that’s generally granted to hourly employees instead of overtime wages. It can sometimes be legal (though it’s often not due to fear of employer abuse) but employers must pay it at 150%, the same rate as overtime wages. To give employees to take compensatory time or extra paid time off in lieu of overtime pay is illegal under federal law. Furthermore, those who do take the compensatory time option aren’t always guaranteed time off whether they want it or need it.

- Employees Not Allowed to Report Work over 40 Hours Per Week– Many employers have rules that no overtime work will be permitted or paid for unless authorized in advance. Some employers choose to ignore when hourly employees work overtime or don’t allow employees to work overtime hours. This violates overtime rules.

- Misclassification of Employees as Exempt Workers– Exempt employees are by law workers not entitled to receive overtime pay. Whether an employee is exempt or not can be confusing. However, it has nothing to do with one’s job or job description or whether one is paid a salary or hourly. It depends on what an employee actually does on their job on a daily basis that determines whether or not they’re legally entitled to overtime pay.

Not Paying for Meals and Rest Period Pay – Meals need not be counted as work time if they are at least 30 minutes long and the employee is relieved from active duty during the meal period even if they must remain available. An employee who works through lunch is working and that time must be counted. An employee who eats a sandwich at the desk or is required to monitor a machine is working through lunch. However, many employers who have their employees work through lunch are guilty of this.

Not Paying for Off the Clock Work– Many FLSA lawsuits involve employers failing to include time spent by employees performing work activities outside their normal shifts. Some may come early and start working before the official start time of their shifts. Such time is work time and must be included in FLSA pay computations, provided only that the employer knew or should’ve known that the employee was beginning work early (and to the extent that the employee spent pre-shift time performing work activities). Pre-shift roll calls are work time. Time spent setting up equipment before the official start of a shift is work time. Some employees may similarly stay late after shifts performing works which should be counted as work time as well. Travel time and on-call time is work time. Time spent by an employee cleaning equipment after the close of a shift is work time. Post shift work time can also include time spent by an employee performing job related activities on the way home like a secretary dropping off the day’s mail at the post office or delivering some paperwork to a customer or supplier. Some employees take work home. That time may well be work time. Similarly if an employee is contacted at home by phone for work related reasons, the time spent is work time (as well as when an employee is called back to work, the time counts as work time). This is a very common wage violation by employers.

Minimum Wage– The federal minimum wage is $7.25 an hour. It’s a poverty wage that’s not able to support a family but that’s beside the point. For tipped workers, it’s $2.13 an hour as long as it’s fixed and the tips add up to be at the federal or above the federal minimum wage which I think is stupid. Some states also have legislation that sets a state minimum wage as well. Depending on the state, the employee is always entitled to the higher standard of compensation. A common form of wage theft for tipped employees is to receive no standard pay and stealing tips. The Wage and Hour Division is said to be generally contacted by 25,000 people a year in regards to concerns and violations of minimum wage pay. Paying employees less than minimum wage is a very common wage theft practice.

Missclassification is a common method of wage theft in which employers try to pass their workers off as independent contractors. The difference between employee and independent contractor is in this infographic.

Misclassification– One of the more extensive and insidious forms of wage theft which leaves workers especially vulnerable. Under the FLSA, independent contractors aren’t covered by tax and wage laws that apply to regular employees. Nor do they receive the same protection as employees for certain benefits. Thus, independent contractors aren’t entitled to a minimum wage, overtime, insurance, protection, or other employee rights. Nor do employers pay Social Security, Medicare, payroll taxes, or federal unemployment insurance on contract employees. Independent contractors also have to pay payroll taxes to the IRS. The difference between the two classifications depends on the permanency of employment, opportunity for profit and loss, as well as the worker’s level of self-employment along with their degree of control. Nevertheless, employers are strongly motivated to classify regular employees as contract workers to save costs, a practice known as pay roll fraud. A 2007 study in New York state found that 704,785 workers or 10.3% of the state’s private sector workforce was misclassified each year. For industries covered in this study, average unemployment insurance taxable wages underreported due to misclassification was on average $4.3 billion for the year while the unemployment insurance tax underreported in these industries was $176 million.

Illegal Deductions– Employees are subject to forms of wage theft through this method. Trivial to sometimes fabricated workplace violations are used to validate deductions. Any deduction that brings an employee to a level of compensation less than the minimum wage is also illegal. In many states, employers are required to issue employees documentation of deductions along with earnings. Failure to issue such documentation is generally prevalent in workplaces subject to wage theft.

Full Wage Theft– Employers are legally obligated to pay employees. However, this doesn’t always happen and is the most blatant and extreme form of wage theft.

Other– These may include putting pressure on injured workers not to file for workers’ compensation, being denied time off or vacation time they have required, being denied pay for sick leave or vacation time, not paying final paycheck to workers who’ve left, delaying payments (not paying on scheduled paydays or on a timely basis), bounced paychecks, stealing and pooling tips, unpaid internships, not reimbursing expenses, not keeping or fabricating records of hours worked, not paying for training, and under staffing. These could depend on state and local jurisdictions.

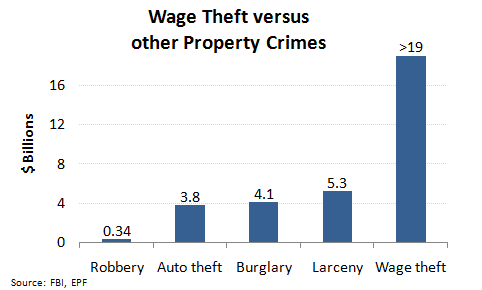

According to the FBI, more money is lost to wage theft than in any other property crimes including robbery, auto theft, burglary, and larceny. And money number is only from the reported cases.

How Common Is Wage Theft?

Wage theft is widespread in the United States existing in all professions and affecting all workers regardless of race, gender, or legal status. When it comes to ripping employees off, employers don’t discriminate. But low-income workers and immigrants tend to be the most vulnerable. Yet, this could happen to higher income employees as well such as in high tech companies. So don’t think you can’t become a victim of wage theft because you can. While no one knows exactly how big this problem is, federal and state agencies have recovered $933 million for wage theft victims in 2012 while property taken in all thefts and robberies amounted to under $341 million. Research suggests that American workers are getting screwed out of $20 billion to $50 billion annually. The odds of you becoming a victim of wage theft are likely but some workers are more vulnerable than others.

Undocumented immigrants are the most vulnerable to wage theft due to their precarious legal status that leaves them unable to speak up without risking deportation. Many employers take full advantage of this by paying them under the table and threatening to call immigration on them if they get out of line.

Who Are Most Vulnerable to Wage Theft?

Low income workers are the most vulnerable to wage theft, particularly in fields that employ women, people of color, and foreign born populations. Foreign-born women are at a much greater risk for wage violations than their male counterparts. Undocumented immigrants stood at the highest risk levels. Education, longer tenured employment, union membership, and English proficiency proved to be influential factors in reducing wage theft for the aforementioned demographics. Wage theft is more common in small businesses with less than 100 employees than larger companies. Workplaces with flat rate compensation or cash under the table payments also reported a higher instance in wage theft. We should also take into account that while low income workers are most vulnerable to wage theft, they’re the least likely to report it as well as suffer the most devastating consequences. When a worker only earns a minimum wage ($290 for a 40 hour workweek), shaving a mere half hour of the day from the paycheck could mean a loss of more than $1,400 a year, including overtime premiums. That could be nearly 10% of a minimum wage employee’s earnings which could be the difference between paying the rent and utilities or risking eviction and the loss of gas, water, or electric service.

This infographic illustrates the real costs of wage theft which consist of less income, time poverty, and a poor workplace environment. Wage theft is wrong, it hurts families, it hurts people’s well being, and leads to further worker abuse.

Why Is Wage Theft Bad?

Think of it this way, if you spend several hours working your ass off and your boss doesn’t pay you the money or benefits you should be receiving, you would surely feel very upset about it. After all, you worked for it, you earned it. Therefore, your employer is required to pay you for all the work you did for them. This is how the employer-employee relationship is supposed to work. If your boss doesn’t pay what you deserve, then it’s obviously unfair. Your boss is ripping you off. Wage theft costs workers billions of dollars a year, a transfer from low income employees to business owners that worsens income inequality, hurts workers and their families, and damages the sense of fairness and justice that a democracy needs to survive. And when low wage workers are underpaid, taxpayers face the burden of supporting workers whose employers haven’t paid into Social Security taxes and other funds. Plus the millions of dollars lost in tax revenue. Not only that, but the money your average low income worker loses in unpaid wages is not reinvested in the economy. Meanwhile businesses who do pay their employees without resorting to wage theft find it hard to compete in a market with their additional employee-related expenses.

Employers resort to wage theft because it keeps their costs down, saves them money, and easily get away with it. In other words, when it comes to profit margins, wage theft is good business despite being illegal.

Why Would Employers Commit Wage Theft?

Many businesses violate wage and hour laws for 3 reasons. First, paying employees less gives them a competitive advantage or higher profit and have little fear of getting caught or punished. If a business can get away with illegally paying its employees a below minimum wage with no overtime, it will be able to sell its products more cheaply than one who complies with the laws and pays their workers time-and-a-half for overtime work. If a business pays its “interns” nothing while its competitors all pay interns the minimum wage, it will be able to charge clients less and steal business away from its competitors. Second, even if a business doesn’t lower prices to undercut competitors, it still pockets the difference between the wage owed and the wage paid. Thus, the employee’s loss is the owner’s extra point. Third, there’s a very low chance the employer will be caught cheating on wages so most don’t usually think twice about the consequences. After all, employers usually can afford the better legal defense and the fact wage theft laws are typically weak and insufficiently enforced. As of 2014, there are only 1,000 to 1,100 federal Wage and Hour Division investigators for the whole country who are responsible for investigating over 7 million businesses and protecting over 100-135 million employees. In 2012, they only conducted fewer than 35,000 investigations and recovered about $280 million in unpaid wages to 308,000 workers. State labor departments and attorneys general combined recovered even less. Not to mention, many federal wage theft cases are thrown out because the Department of Labor couldn’t resolve them within two years. At the state and local level, it’s often even worse since few local governments have the resources to combat wage theft and several states have cut their labor department’s. Even if businesses do get caught, they’re rarely punished. Consequences for violations found are often no more than an order to pay back the wages owed or even a fraction of the total amount. This despite that the FLSA makes the employer liable for the full amount as well as additional equal amount for liquidated damages. But at any rate, the FLSA’s civil penalties for willful and repeat violations are too small to deter offenders from engaging in similar violations in the future. For instance the maximum penalty for failure to pay overtime and minimum wage being $1,100 whether the culprit be some local ice cream shop or a giant multinational corporation like Walmart. Yet, Wage and Hour failed even to seek a penalty in most of its cases for many years. And despite that the FLSA makes repeated willful pay violations a misdemeanor punishable by up to 6 months in jail, criminal penalties are rarely if ever used. At state and local levels, wage theft laws can be even weaker while enforcement is even more insufficient.

Wage theft often goes underreported mostly because the party with the power and resources is often the perpetrator or the employer. Victims who decide to take action often face uphill battles, lost savings, lost careers, and possibly very little back pay and justice if they win. It’s a very sad situation.

Why Does No One Talk About Wage Theft?

Because unlike your typical property crimes, wage theft usually happens behind closed doors and is not easily detectable. It’s also conducted by more powerful people typically stealing from those with few resources to do anything about it. In fact, many workers may not realize their employers are stealing from them for years into their job. Or may not know that their boss may be doing anything illegal or violating their rights under the law. But if they do, they may not report the incident anyway if calling out their employer means losing their job or other forms of retaliation like shorter hours, less pay, or increased workloads. Many immigrants are often confronted with threats of calls to immigration services if they complain or seek to redress, especially if they’re undocumented. Some employees in white collar professions are even threatened with criminal prosecution or possibly blackmail to keep them from leaving. Even if they do sue and win, they often end up losing their careers and possibly their life savings to litigation fees. As for settlement, most workers who win their wage theft case usually don’t see a dime. Not to mention, it rarely makes front page news unless the case pertains to a class action lawsuit against a large corporation. So wage theft remains vastly under reported though cases filed in federal court have been on the rise.

In 2009-2011, warehouse workers sued Walmart for paying them less than minimum wage as well as denying the paid vacations they were promised. Walmart denied this because wage theft is one of the ways the retail giant does to ensure you save more, live better, and contribute to their profits.

What Are Effective Measures to Deter Wage Theft?

The US FSLA requires employers to keep detailed records regarding workers’ identities and hours worked for all who are protected under the minimum wage law. Most states require that employers also provide each worker with documentation every paid period detailing that worker’s hours, wages, and deductions. As of 2011, Arkansas, Florida, Louisiana, Mississippi, Nebraska, South Dakota, Tennessee and Virginia didn’t require such documentation. A 2008 survey of wage theft from workers in Illinois, New York, and California found that 57% of low wage workers didn’t receive this required documentation and that workers who were paid in cash or on a weekly rate were more likely to experience wage theft. So making employer documentation legally mandatory is an effective measure though not so much when it comes to tip theft. As for other enforcement measures, while willful violators can fines up to $10,000 upon their first conviction to jail time resulting from repeat offenses. However, since the WHD is so underfunded and so understaffed (which isn’t an accident), very few wage theft cases are investigated and fewer employers are brought to justice.

Most of the wage theft awareness campaigns usually tend to be localized and statewide. But wage theft is so widespread that Americans need to have a nationwide conversation about this. Wage theft is a very insidious crime that’s happening everywhere. We need to demand action to deter this behavior. We need to show that wage theft is an unacceptable way of doing business.

What Steps Can Be Done to Prevent and Stop Wage Theft?

First, wage theft needs to be addressed as a national issue in the national spotlight because there are stories that are barely heard on TV unless they pertain to Trump’s business shenanigans or NFL cheerleaders. Second, raise funding for the WHD so they could hire more staff to investigate (which should be doubled) as well as better laws that put stiffer penalties on employers. Third, protect victims filing complaints with government agencies from retaliation and allow them to access the back pay they’ve been so long denied if they decide to sue.There must be ways for wage theft victims to complain and stick up to their employers so they won’t have to worry about losing their jobs or their life savings. Fourth, fix the statute of limitations on wage claims for more than two years. Fifth, mandate that employers give workers pay stubs so they could accurately calculate their hours and have a record to prove they were cheated, which most states do anyway as well has been a proven deterrent. Sixth, have the DOL engage in targeted investigations of industries and employers where wage theft is rampant in partnership with community organizations workers trust and know who the criminal employers are. Seventh, instill stiffer penalties on wage theft violators which includes creating mandatory minimums for employers repeatedly breaking the law as well as make sure that wage theft judgments are enforced so workers could collect what they’ve been denied for years. And finally, provide resources to community organizations with the Department of Labor to eliminate wage theft and win back wages.

Remember, wage theft can be prevented and stopped. The time is now to make unscrupulous employers pay. And I hope the Burger King goes directly to jail and isn’t allowed to collect $200.

Every week I’m a victim of wage theft. Every week my paycheck is smaller because the government steals from me. It’s pretty disgusting that people support this form of wage theft. #TaxationIsTheft

No, the government deducting tax money from your paycheck isn’t wage theft. Paying taxes is a responsibility that comes with living in a society. You know why they’re deducting from your paycheck and that the money is going to services you benefit from anyway but don’t realize it. Or at least you should. Saying that it’s disgusting that people support taxation as a form of wage theft is pure idiocy said by someone who’s right wing, libertarian, flunked social studies in school, or all of the above. Wage theft is committed when employers fail to pay what’s rightfully owed to their employees. Sometimes this could mean a boss paying people less than what a worker is entitled to or promised or not at all. What’s disgusting about that is the fact we have a guy nominated for president by a major party who’s been known to commit wage theft against his workers over the span of 3 decades as well as been sued hundreds of times over it. Such story doesn’t get the media attention it deserves but I think it speaks volumes on how Donald Trump is such a piece of shit. I mean he’s been known to ruin people’s lives and destroyed businesses with no second thought. And what’s even more disgusting is that a lot of people not only voted for him in the primaries and will in the general election, but also proudly support him. It’s appalling that the American people can let a man who doesn’t pay his employees get so close to the presidency. If you’re one of those Trump supporters I’m talking about, then I recommend you see someone and get your head examined.

how about people will NEVER get a day off for sunday or saturday or never any holidays? such as even christmas and new year?

restaurant job? do you think its reasonable to have some ocassion holiday off?

pretty sure the employer can manage that.

any thoughts?

You have valid point and yes I think it’s reasonable for people to have some occasional holiday off. And while I’m aware that a lot of businesses enjoy a great profit on the weekends, I do believe that employers can manage giving their workers an occasional holiday off. I was pissed off when I heard Wal Mart announce that they’d open their Black Friday sale on Thanksgiving, which I think is very unfair to workers. I also think it’s appalling that most workers don’t have paid family or sick leave and the fact that a lot of parents have to return to work shortly after their kids are born even when it’s medically advisable not to. Not to mention, the fact that people work full-time jobs on minimum wage which is too little to support a family. I even believe that employers should have no say on whether or not to allow workers have union representation. Being part of a union should be an employee’s decision alone, not their boss’s. The fact employers have so much power over their workers these days has people’s lives so miserable that many of them are only willing to abide to their demands out of fear of being fired and replaced. And it doesn’t help that these employers can get away with so much shit like not paying employees what they’re rightfully owed for their work and other types of abuse. I focused on wage theft because there are laws against it which are being frequently broken while workers are paying the price. But you’re right about how employers should be able to give their workers a day off such as the occasional holiday. However, the problem is that many of the big name employers like Wal Mart tend to set the business standards in order to maximize their profits, usually out of greed. And this usually leads to competitors following suit as well as tend to go against the workers’ best interests. As in the case with wage theft, the fact a lot of employers who shortchange their employees tend to have an edge in the competition really hurts businesses trying to play by the rules, especially if we’re talking small businesses here.