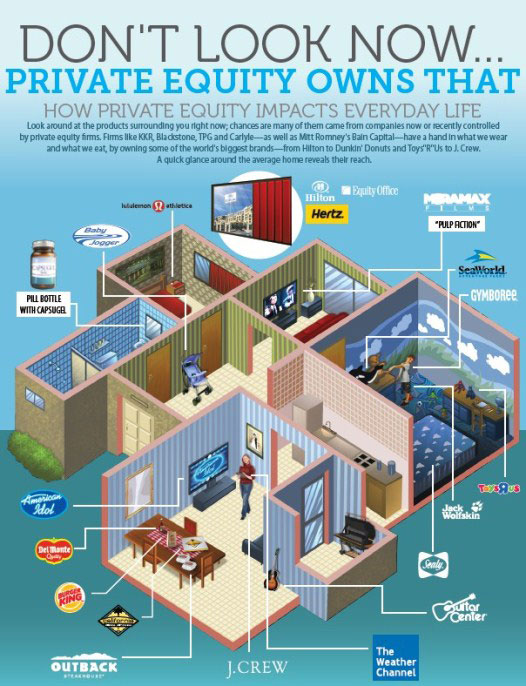

Within the last 40 years as economic power shifted from workers to owners, corporate profits take of the US economy has more than doubled. Yet, despite corporate profits at an all-time high, job growth remains anemic, wages are flat, and the country can’t even afford its basic needs. A $3.6 trillion budget shortfall has left many roads, bridges, dams, and other public infrastructure in disrepair. Federal spending on economically crucial research has plummeted by 40%. Public college tuition has more than doubled since the 1980s, burying recent graduates under $1.2 trillion in student debt. Not to mention, many public schools along with police and fire departments are dangerously underfunded. So where did all the money go? After all, public companies have nearly $2 trillion in cash just sitting on their balance sheets. So Corporate America has the resources to deploy a lot of money, invest in new technologies to draw growth, give workers a much-needed raise across the board, hire and train employees, build new facilities, pay off loans, pay shareholders, and pay taxes to the government.

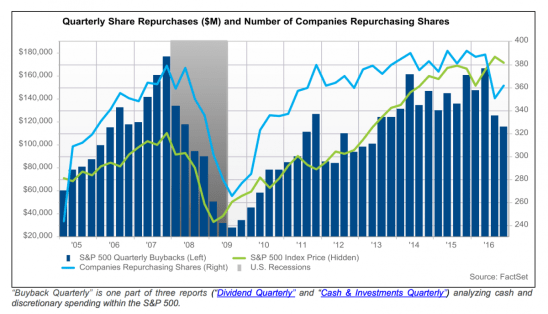

Since the 1980s, stock buybacks have grown in popularity on Wall Street as this graph shows. As Sen. Elizabeth Warren told The Boston Globe, “stock buybacks create a sugar high for the corporations. It boosts prices in the short run, but the real way to boost the value of a corporation is to invest in the future, and they are not doing that.”

But no. Instead, companies keep spending more and more money on stock buybacks. Once illegal and considered insider trading until 1982, stock buybacks have become increasingly popular especially since the 2008 recession. Today, these buybacks have become one of the biggest trends in the post-financial-crisis stock market and the largest source of net demand since 2009. Since 2010, 1,900 companies have spent money on buybacks and dividends with a combined return of capital to shareholders for them equaling 113% of capital spending. So much that a growing number of companies are borrowing money to fund the buybacks. Thanks to Donald Trump’s massive corporate tax cuts, American companies have lavished Wall Street with $171 billion of stock buyback announcements this year, a record high. All in all, Corporate America has pledged 30 times more buying back its own stock than investing in its workforces. Thus, the money these companies make through their financial manipulations drives record-level profits.

Proponents say they reward these long-term shareholders by effectively increasing their company ownership and help boost a stock’s value by raising its earnings per share. When there’s no other compelling use for a company’s cash, this is a better alternative than risky spending or other big investments. But its critics think that buybacks only make things look better than they seem. Indeed, the EPS rise but not because earnings are growing. In other words, they just exist to make shareholders feel better but nothing really changes. Even some of their fiercest proponents claim they’re overused. And in recent years, evidence shows that buybacks haven’t helped boost stock values at all. Other critics argue that buybacks result in companies acting more like banks that hold assets and earn interests and less like a business making money off selling goods and services. Or invest their profits in their workforce and other productive ventures. According to the Academic-Industry Network’s William Lazonick, “Buybacks are not beneficial or necessary to household savers with diversified investments. The only ones who benefit are those who dump shares and are strictly in the business of timing.”

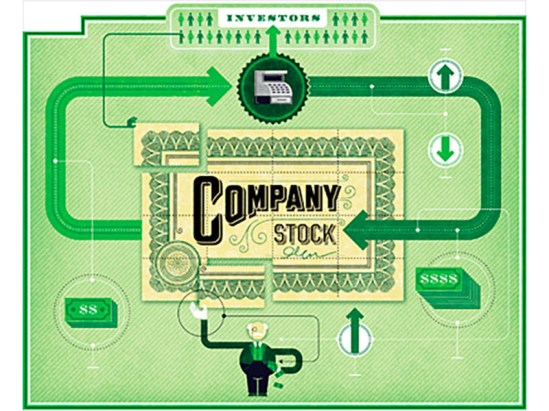

What are stock buybacks?

Also known as a “share repurchase,” is a company’s buying back its shares from the marketplace. Think of it as a company investing it itself or using its cash to buy its own shares. The concept is simple: because a company can’t be its own shareholder, it absorbs repurchased shares and reduces the number of outstanding shares on the market. When this happens, each investor’s relative ownership stake increases on the company’s earnings.

How are stock buybacks carried out?

They’re made in 2 ways:

1. Tender Offer– company may present shareholders with a portion of all their shares within a certain time frame. This will stipulate both the share number the company wants to repurchase and the price range they’re willing to pay (almost always at a premium to a market price). When investors take up the offer, they’ll state how many shares they want to tender along with the price they’re willing to accept. Once the company has received all the offers, it’ll find the right mix to buy the shares at the lowest cost. Tender offers can be a way for executives with substantial ownership stakes and care about a company’s long-term competitiveness to take advantage of the low stock price and concentrate ownership in their own hands. This can free them from Wall Street’s pressure to maximize short-term profits and allow them to invest in the business. But they should only be made when the share price is below the company’s intrinsic value of its productive capabilities and the company is profitable enough to repurchase the shares without impeding its real investment plans.

2. Open Market– company buys shares on the open market just like an individual investor would at market price. It’s important to know that when a company announces a buyback, the market usually perceives it as a positive thing, causing the stock price to shoot up. 95% of buybacks are these. Yet, they often come at the expense of investment in productive capabilities and aren’t good for long-term shareholders. When I discuss stock buybacks, I’m usually referring to the open market variety which used to be illegal and considered insider trading until 1982.

3. Dutch Auction– an alternative form of tender offer which specifies a price range within which the shares will be bought. Shareholders are invited to tender their stock if they wish at any price within it. The firm then compiles the responses, creating a demand curve for the stock. The purchase price is the lowest price allowing the firm to buy shares sought in the offer. And the firm pays that price to all investors who tendered at or below that price. If the share number exceeds the number sought, the company buys less than all shares at or below the purchase price on a pro rata basis to all tendering at these rates. If too few shares are tendered, the firm either cancels the offer or buys back all the tendered shares at the maximum price.

Why would a company want to use buybacks?

A firm’s management may tell you that a buyback is the best use of capital at a time since their goal is to maximize returns for shareholders. Buybacks generally increase shareholder value, at least on the surface. The prototypical line in a buyback press release is “we don’t see any better investment than in ourselves.” This can sometimes be the case but it’s not always true. Nonetheless, there are still sound motives driving companies to buy back shares. Management might think the market has discounted its share price too deeply due to weaker-than-expected-earning results, an accounting scandal, or a poor overall economic climate. Thus, when a company spends millions of dollars buying up its own shares, it means management believes the market has gone too far discounting its shares. More importantly, share buybacks can be a fairly low-risk approach to use extra cash since reinvesting money into R&D or a new product can be very risky. If these hard-earned investments don’t pay off, then that hard-earned cash goes down the drain. Using cash to pay for acquisitions can also be perilous. Mergers hardly live up to their expectations.

Another reason is that companies don’t want to just sit on money, much for the same reason that investors don’t like holding piles of cash either: inflation erodes cash value, so putting it to work makes sense. During periods of economic growth, it’s better to allocate profits to capital (like a factory) or labor as an investment to the firm’s future. But it’s also risky because the economy could worsen. Though I’m not sure if I actually agree with this since I think stagnant wages are part of why the economy isn’t getting any better. So in periods of economic uncertainty, companies choose to give the cash to their shareholders, which should’ve went to their workers. As the head of S&P Investment Services Mike Thompson told Business Insider in 2016, “In an environment like this return cash to shareholders keeps them pleased with the short-term gains while not committing to large investments that could hurt performance.”

Increased Shareholder Value– there are many ways to value a profitable company but the most common measurements is Earnings Per Share (EPS). If earnings are flat but the number of outstanding shares decreases.

Increased Float– as the number of outstanding shares decreases, the remaining shares represent the float’s largest percentage. Increased demand and less supply means a potentially higher stock price.

Excess Cash– buybacks are usually financed with a company’s excess cash, demonstrating that it doesn’t have a cash flow problem. More importantly, it signals that executives feel that cash re-invested will get a better return than alternative investments.

Improving Financial Ratios– or improving metrics upon which the market seems heavily focused on, which is questionable. If reducing shares isn’t done to create more value for shareholders but rather make financial ratios look better, the management likely has a problem. However, if a company’s motive for initiating a buyback program is sound, its financial ratio improvement in the process might be the result of a good corporate decision. For one, share buybacks reduce outstanding shares. Once a company buys these, it often cancels them or keeps them as treasury shares. They also reduce assets on the balance sheet and increase return on assets and equity. They also improve a company’s price-earnings ratio as the market often thinks lower is better.

Dilution– another reason for a buyback may be a company’s wish to reduce the dilution often caused by generous employee stock option plans. Bull markets and strong economies often create a very competitive labor market. So companies have to compete to retain personnel and ESOPs which comprise of many compensation packages. Stock options increase the share number when exercised, which weakens a company’s financial disposition.

Price Support– companies with buyback programs in place use market weakness to buy back shares more aggressively during market pullbacks. This reflects confidence that a company has and alerts investors that it believes the stock is cheap. Often a company will buy back its stock after taking a hit, which is an overt action to take advantage of discount prices on its shares. This lends support to the stock’s price and ultimately provides security for long-term investors for rough times.

Higher Stock Prices– an increased in EPS will often alert investors that a stock is undervalued or has the potential for increasing in value. The most common result is an increase in demand and an upward movement in the stock’s price.

Tax Benefit– while a buyback is similar to a dividend in many ways, it has a major advantage over dividends of a lower capital gains tax rate. Whereas dividends are taxed at ordinary income tax rates.

Does that mean stock buybacks are good?

Not necessarily. Sometimes buybacks can be a great thing if a stock truly is undervalued and represents the best possible investment for a company. But a company must meet certain specific conditions:

1. The stock should be trading at price to economic book value below 1, meaning that the company is buying back shares for cents on the dollar.

2. The company’s balance sheet and free cash flow should be strong enough to support a buyback without jeopardizing future liquidity or investment opportunities.

3. The company should have more cash than it does profitable investment opportunities.

One company meeting all three criteria is Oracle who bought back $8.1 billion in stock (5% of its market cap), reducing outstanding shares by 120 million. Its shares currently trade at a PEBV of 0.9, meaning it’s buying back shares at a 10% discount rate to their zero-growth value. With $50 billion in excess cash on its balance sheet and $9 billion in annual free cash flow, Oracle has more than enough cash on hand to support its buyback program, and more than it could reasonably hope to profitably invest in the near term as of 2016. Oracle’s buybacks don’t just serve their shareholders’ interests, they also benefit the overall economy. When a company with excess cash and few investment opportunities buys back its stock, it puts that cash back in the marketplace for individual investors to distribute to companies needing capital. In buying back billions of dollars in its own stock, Oracle cheaply retired its shares without comprising its ability to invest in future growth.

While there are buybacks that make sense from a capital allocation standpoint and serve the investors’ best interests like in Oracle’s case, these are normally the exception rather than the rule. In fact most companies buying back stock aren’t in Oracle’s situation. If a company merely uses buybacks to prop up ratios, provide short-term relief to an ailing stock price, or get out from under excess dilution, watch out. Oftentimes, they can be a downright bad idea and can hurt shareholders. This can happen when buybacks are done in the following situations:

1. When Shares Are Overvalued– companies should only pursue buybacks when their shares are undervalued. A company that buys overvalued stock destroys shareholder value and would be better off paying that cash out as a dividend, so that investors can more effectively invest it. As Warren Buffett said to Berkshire Hathaway shareholders in 1999, “Buying dollar bills for $1.10 is not good business for those who stick around.”

2. To Boost Earnings Per Share– since buybacks can boost EPS, a company stock buyback in the market reduces outstanding share count. This means earnings are distributed among fewer shares, raising EPS. Thus, many investors applaud share buybacks since they see increasing EPS as a surefire approach to raising share value. However, contrary to popular belief, increasing EPS doesn’t raise fundamental value. Companies must spend cash to buy these shares. In turn, investors must adjust their valuations to reflect reductions in both cash and shares. Sooner or later this cancels out any EPS impact. In other words, lowering cash earnings divided between fewer shares won’t produce any net change to EPS. Of course, a major buyback announcement generates plenty of excitement since a prospect of even short-term EPS can give share prices a pop-up. But unless the buyback is wise, the only gains go to those investors selling their shares on the news. There’s little if any benefit for long-term shareholders.

3. To Benefit Executives– many executives get the bulk of their compensations from stock options. As a result, buybacks can serve a goal: while stock options are exercised, buyback programs absorb the excess stock and offset dilution of existing share values and any potential reduction in EPS. By mopping up extra stock and keeping EPS, buybacks are a convenient way for executives to maximize their own wealth as well as maintain share value and options. Some executives may even be tempted to pursue share buybacks to boost share buybacks to boost the share price in the short-term and sell their shares. In addition, big bonuses that CEOs receive are often linked to share price gains and increased EPS. Thus, they have an incentive to pursue buybacks even when there are many ways to spend the cash or when their shares are overvalued.

4. Buybacks Using Borrowed Money– the temptation using debt to finance EPS can be hard to resist for executives. The company might believe that the cash flow it uses to pay off the debt will keep growing, bringing shareholder funds back into line with borrowings in due course. If they’re right, they’ll look smart. If they’re wrong, investors will get hurt. Moreover, managers assume that their companies’ shares are undervalued regardless of the price. When done with borrowing, share buybacks can hurt credit ratings, since they drain cash reserves that can serve as a cushion when times get tough. One of the reasons given for taking on increased debt to fund a share buyback is that it’s more efficient since the debt’s interest is tax deductible. However, all debts must be repaid at some time. Because what gets a company into financial difficulties isn’t lack of profits but lack of cash. With debt, buybacks become more complicated which doubles the risk since a firm’s leverage levels may cause financial distress in the future and harm shareholders in the long-term.

5. To Fend Off an Aquirer– in some cases, a leveraged buyback can be used as a means to fend off a hostile bidder. The company takes on significant additional to repurchases stocks through a buyback program. Such leveraged buybacks can be successful in thwarting hostile bids by both raising the share value and adding a great deal of unwanted debt to the company’s balance sheet.

6. There Is Nowhere Else to Put the Money– it’s very hard to imagine a scenario where buybacks are a good idea, except when a company feels like its share price is far too low. But if the company’s right about undervalued shares, they’ll probably recover anyway. Thus, companies buying back shares are, in effect, admitting that they can’t invest their spare cash flow effectively. Even the most generous buyback program is worth little for shareholder if it’s done in the midst of poor financial performance, a difficult business environment, or a decline in the company’s profitability. By giving EPS a temporary lift, share buybacks can soften the blow. But they can’t reverse things when a company is in trouble.

Why do companies actually use buybacks?

In theory, corporations should have a distinct advantage over the rest of the market when buying back shares. After all, executives know their industry, the company’s challenges, and their strategic plans better than anyone else. This should enable them to buy their stock when it’s cheap and not when it’s overvalued.

But most companies carry out buybacks for reasons that have nothing to do with maximizing shareholder value. Pressure to hit short-term earnings targets and executive compensation plans often incentivize the wrong metrics which often push companies to buy back stock when it’s most expensive and the money could be better used elsewhere. This is what the Harvard Business Review calls “The Overvaluation Trap.” Data shows that companies buy back more stock during booms and sell them during market crashes. In this way, less like the knowledgeable executives and more like panicky and underperforming investors.

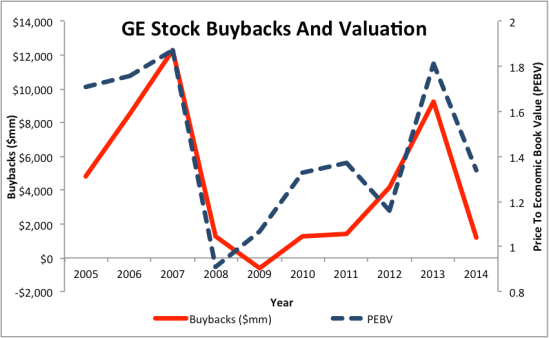

This 2016 Forbes graph of GE stock buybacks and its valuation. You can see that instead taking the traditional investor advice of “buy low, sell high,” they actually have bought high and sold low. As a result, their stock has lost value.

A graph from Forbes shows this value-destroying behavior for General Electric by comparing between the amount of money spent buying back shares and the price to economic book value, a measure of growth expectations embedded in the stock price. As this graph illustrates, GE bought back an incredible $12.3 billion worth of stock in 2007, just before the market crashed. At the start of the bull market in 2009, the company sold off $600 million worth of its own stock. Throughout the last decade, you can see a high correlation between how expensive GE’s stock is versus current cash flows and how much stock the company buys back. Overall, in the last decade, GE bought back $44 billion of its own shares (17% of its market cap). Yet, its stock fell by 15% over that same time. By inefficiently utilizing valuable capital to buy back stock at inflated prices, GE destroyed value for long-term shareholders. When a company’s equity is overvalued, its executives have to scramble to justify that expensive price. One way to do that is by artificially boosting the EPS through share buybacks. As this Forbes graph above shows, GE does this effectively as the company managed to hit or beat EPS in 15 out of past 16 quarters.

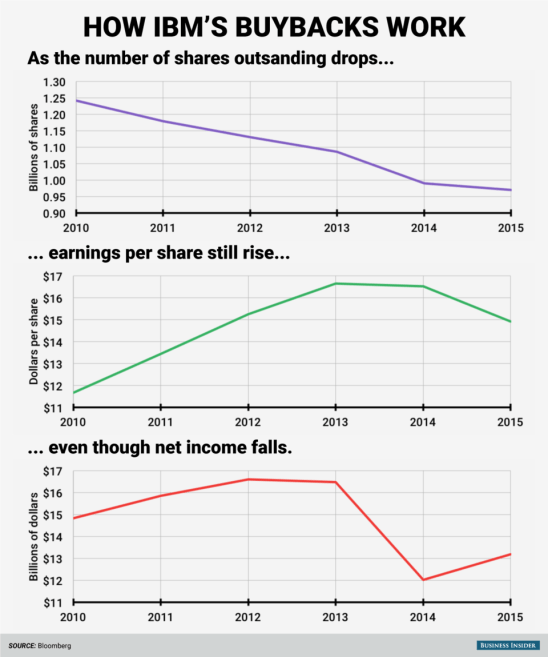

Business Insider’s graph on IBM also shows how buybacks might make the EPS look good as the number of outstanding shares drops. Despite that the net income has fallen, which isn’t a good sign in most businesses.

Another case is IBM who spent $4.6 billion in 2015 and $125 billion in the decade prior as of 2016. According to a Business Insider graph, from 2010 to 2015, its total share count was down by about a fifth while earnings per share rose 15%. Yet, in that same period, IBM’s actual income went down 11% as sales fell, too. As a result, IBM has lost about $50 billion in market value since 2013, or about 30%.

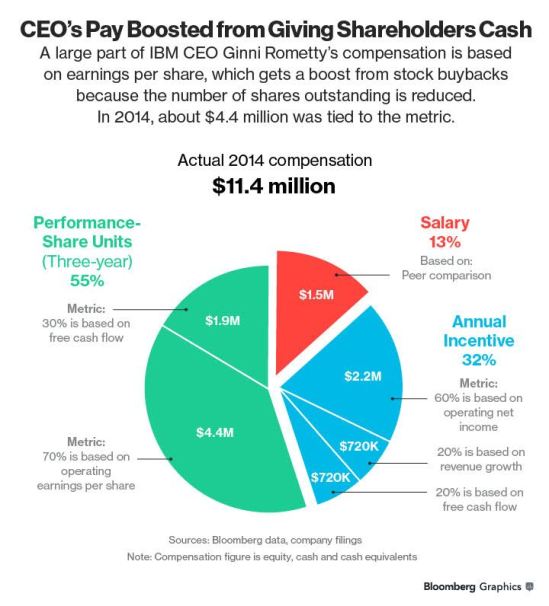

Since executive pay is often tied to stock compensation, top Wall Street execs have often been pressured to do buybacks to increase their coffers. Even if it makes no strategic financial sense. It’s part of a phenomenon called greed. This is a Bloomberg graph of IBM’s CEO compensation.

Also, many companies have executive compensation packages incentivizing excessive share buybacks, either directly or indirectly. In GE’s case, a percentage of its bonuses depends on the company returning a certain amount of cash to shareholders. In 2014, executives had to make sure combined dividends and buybacks hit at least $10 billion to get their full bonus, even if that decision made no strategic sense. But it makes perfect sense in regards to greed. Because when share prices go up, CEOs reap a bonanza so the value of their pay also rises in what amounts to a retroactive and off the books pay increase on top of their already humongous compensation packages. As a result, the very people we rely on to make investments in the productive capabilities that will increase our shared prosperity are squandering most of their companies’ profits for their own prosperity. The Academic-Industry Network’s William Lazonick told The American Prospect, “All of those trillions of dollars flowing out of companies are being used to build the war chests of hedge-fund activists for further buybacks or [giving them more] money to play around with on derivatives. When you connect the dots, it’s part of bigger process. This is really a long-run problem that helps to explain concentration of income at top because it’s getting made off the stock market.

Other companies incentivize share buybacks through emphasizing metrics that can be easily manipulated and have little impact on shareholder value. For example, Cisco executives are judge in part on their ability to grow adjusting operating income, adjusted EPS, and operating cash flow. That term “adjusted” is crucial since Cisco uses metrics for judging executive performance exclude share-based compensation. Meaning that executives can pay employees (and themselves) with stock instead of cash, buy back shares to offset dilution, and increase these adjusted metrics to improve real operating performance. In 2015, Cisco bought back 155 million shares. But after effects of employee stock compensation, it only reduced the total outstanding shares by 38 million. So all those buybacks are just trickery executives use to boost their own bonuses.

And it’s not just GE, IBM, and Cisco. According to FactSet data by Andrew Birstingal, the performance of companies engaging in buybacks has been disappointing. “In the past year, companies repurchasing shares saw an excess weighted cumulative return of -1.9% relative to the benchmark, while companies not repurchasing shares saw a return of 9.8% relative to the benchmark,” he said in 2016. On a three-year horizon, those companies buying back shares ended up with a -2.9% return against 11.5% gain for those not buying back stock. A study found that companies completing buybacks outperformed their benchmark before 2001. Yet, those who completed buybacks between 2002 and 2006 didn’t generate better returns since that time than those who didn’t. Based on this research, buybacks aren’t helping share prices in either short- or long-term.

However, the cost of buybacks doesn’t just come from overpriced stock losses, but also from missed opportunities to invest growth and innovation. Over the past decade, AT&T bought back $50 billion in stock which could’ve been used to improve its wireless network quality and catch up with Verizon which doesn’t buy back stock. All those buybacks didn’t keep AT&T from underperforming versus Verizon and the broader market. We tend to think of buybacks as a sign of success proving a company has plenty of cash to throw around. In reality, they amount to admission of failure for a company buying back stock signals the market that it lacks profitable investment opportunities.

So what’s the deal with stock buybacks and the economy?

Stock buybacks don’t give any incentives for companies to use profits in improving their enterprise and raising workers’ wages. The frequency of buybacks have led to increased economic inequality and more money going to the 1%.

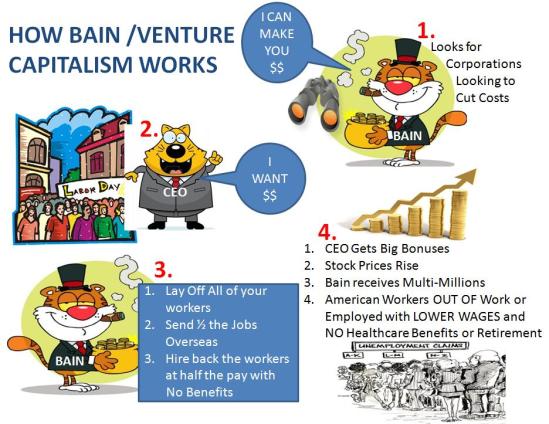

Before the Security and Exchange Commission loosened regulations that gave companies an ability to repurchase stock without facing charges of stock manipulation and a shift toward stock-based compensation toward top executives, corporate money flowed through the broader economy in the form of higher wages or increased investments in plants and equipment. But today, these stock buybacks drain millions of dollars of windfall profits out of the real economy and into a paper-asset bubble. This inflates share prices while producing nothing of tangible value. Corporate managers have always been pressured to grow earnings per share, but where once the only option was the hard work of actually growing earnings by selling better products and services, they can now simply manipulate their EPS by reducing the number of outstanding shares. As a result, it has become a gigantic game of “keep away” with CEOs and shareholders tossing a $700 billion ball back and forth over American workers, whose wages as a share of GDP have fallen in almost exact proportion to profits’ raise. Since buybacks give firms no incentives to share their profits with the workers who truly invest in these companies, pouring their lives into them each day for pay increases and stable opportunities. Or the taxpayers who have an interest in whether a corporation that uses government funding can turn a profit that allow it to pay taxes. As the Academic-Industry Network’s William Lazonick told The American Prospect, “The issue is what are they not doing when they do stock buybacks. What they’re not doing is keeping people employed longer, paying them more, and giving them more benefits. There’s a direct connection between the decline of those norms and the rise of buybacks and the legitimized ideology of ‘Shareholder First.’” Over the last decade, 94% of company profits have gone to shareholders through buybacks and dividends.

This practice isn’t just unfair to Americans, but also to individual harmful to both companies and the American economy. A 40-year obsession with “shareholder value maximization” stock buybacks and excessive dividends have reduced business investment and boosted inequality. Now almost all firms carry out investment through retained earnings. Thus, diverting cash flow to stock buybacks has inevitably resulted in lower rates of business investment. And since the 1980s, corporations have bought back more equity than they’ve issued, representing a net negative equity flow. In other words, shareholders aren’t providing capital to the corporate sector like they should. They’re extracting it. Meanwhile the shift to stock-based compensation helped drive the 1%’s rise by inflating the ratio of CEO-to-worker compensation from 20 to 1 in 1965 to 300 to 1 today. Labor’s steady falling share of GDP has depressed consumer demand, resulting in slower economic growth. It’s mathematically impossible to make the public- and private- sector investments necessary to sustain America’s global economic competitiveness while flushing away 4% of its GDP year after year. If the US is to achieve growth distributing income equitably and providing stable employment, government and business must take steps bringing stock buybacks and executive pay under control. The nation’s economic health depends on it.

What should be done about stock buybacks?

The federal government must reorient its policies from promoting personal enrichment to enhancing national growth. Such policies should limit stock buybacks and raise the marginal rate on dividends while providing real incentives to boost R&D investment, worker training, and business expansion.

According to a 2014 Harvard Business Review, a good first step would be an extensive SEC study of the possible damage that open market buybacks have done to capital formation, industrial corporations, and the US economy over the past 3 decades. For instance, during the amount of stock taken out of the market has exceeded the amount issued in almost every year. From 2004-2013, this net withdrawal averaged $316 billion a year. Overall, the stock market isn’t functioning as a funding source for corporate investment.

Another measure we need to do is reining in stock-based pay which should be very limited. Many studies have shown that large companies usually use the same set of consultants to benchmark executive compensation and that each consultant recommends that the client pay its CEO well above average (which is what CEOs want to hear). Thus, compensation inevitably ratchets up over time. They also show that even declines in stock price increase executive pay. So when a company’s stock price falls, the board stuff even more options and stock awards into top executives’ packages, claiming that it must ensure they won’t jump ship and will do whatever necessary to get the stock price up. A 1991 SEC decision allowing top executives to keep gains from immediately selling stock acquired from options only reinforces their overriding personal interest to boost stock prices. Because corporations aren’t required to disclose daily buyback activity, it gives executives the opportunity to trade to trade undetected on inside information about when buybacks are in progress. The SEC at least should stop allowing executives to sell stock immediately after options are exercised. And incentive compensation should be subject to performance criteria reflecting investment in innovative capabilities, not stock performance.

But more importantly, we must transform boards determining other executive compensation. Boards are currently dominated by other CEOs with strong bias toward ratifying higher pay packages for years. When approving enormous distributions to shareholders and stock-based pay for top executives, these executives believe they’re acting in shareholders’ interests. And that’s a big part of the problem. The vast majority of shareholders are simply investors in outstanding shares who can easily sell their stock when they want to lock up gains or minimize losses. Since taxpayers and workers are the people truly investing in the productive capabilities of corporations, they need to have seats on boards of directors. Their representatives would have the insights and incentives to ensure that executives allocate resources to investments in capabilities most likely to generate innovations and value.

If business leaders want to maintain broad support for business, they must acknowledge that a corporation’s purpose isn’t to enrich the few, but to benefit many. Once America’s CEOs refocus on growing their companies over their share prices, shareholder value will take care of itself and all Americans will share in the economy’s benefits. The corporate allocation process is America’s source of economic security or insecurity whether its people like it or not. If Americans want an economy in which corporate profits result in its shared prosperity, the buyback and executive compensation binges will have to end. Sure executives will complain like whiny babies. But the best executives might actual get satisfaction being paid a reasonable salary allocating resources in ways sustaining the enterprise, providing higher standards of living to the workers who make it succeed, and produce tax revenues for the governments providing it with crucial perks.